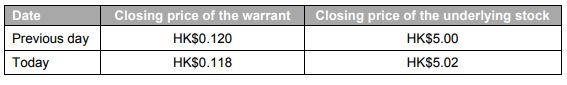

I hold a call warrant linked to an HSI constituent security and the entitlement ratio is 1. The closing price of the warrant and the underlying was as below.

Why did the closing price of the warrant drop while the closing price of the underlying increased?

This could happen because:

(i) some other pricing factors affected the warrant price (e.g. volatility, expected dividend, time decay, etc.) ,

(ii) the market closing time of the warrant and the underlying security was different. Being an eligible security under the closing auction session, it continued to trade in the closing auction session which ended at 4:10 p.m. while the trading in the warrant ceased at 4:00 p.m. In this case, due to the 10 minutes closing time gap, direct comparison of closing price of the warrant and the underlying security might not be appropriate and meaningful, or

(iii) the closing price of the warrant might not reflect the quote price of the liquidity provider. In this case, quotes of the liquidity provider might have moved in line with the underlying but were not reflected in the closing price of the warrant. The closing price could be (1) calculated based on other exchange participants’ trades and quotes; or (2) carried forward from previous days.

You may read further "What is time value and how does it affect the price of a warrant?" and "How does implied volatility of a warrant affect their prices?" .